|

Frequently Violated Rules

| Rule: | Specify the rule being violated |

| Description: | Description on how the rule was violated. This may be multiple entries for a specific rule. |

| Sanction: | Description of applicable sanction/s. |

ARTICLE V- CODE OF CONDUCT AND PROFESSIONAL ETHICS FOR TRADERS AND SALESMEN

ARTICLE VII- CUSTOMER PROTECTION

ARTICLE VIII-CAPITALIZATION REQUIREMENTS OF THE TRADING PARTICIPANTS

ARTICLE IX-BOOKS AND RECORDS RULE

ARTICLE XI-TRADING IRREGULARITIES

|

Rule: Article V, Section 4(c)

"(c) A trader or salesman should use and maintain only one (1) personal dealing account, and only with his firm, which should be registered under his real name. Additionally, he is prohibited from having, opening or using a solo or joint account with any person in any other Trading Participant for the purpose of transacting securities."

Description:

Trader has more than one account.

Sanction: Major Violation (Article XII, Section 4(b))

(b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more than Php30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Classification of Violations:

Article XII, Section 3(b)(iii)

( (iii) Violation of the Code of Conduct and Professional Ethics for Traders and Salesmen;

Rule: Article V, Section 4(d)

"(d) Traders' and salesmen's personal transactions shall require the prior written approval of their firm's Associated Person."

Description:

- Trader/salesmen's personal transaction has no prior written approval from Associated Person.

Sanction: Major Violation (Article XII, Section 4(b))

( (b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more than Php30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Classification of Violations:

Article XII, Section 3(b)( iii)

(iii) Violation of the Code of Conduct and Professional Ethics for Traders and Salesmen;

Rule: Article VII, Section 1(a-d)

Section 1. Customer Account Information Rule. Every Trading Participant shall maintain customer accounts opened as follows:

(a) For each account, the following information:

(i) Customer's name, residence address and residence telephone, and e-mail address, if any;

(ii) Date and place of birth;

(iii) Whether customer is an institutional customer;

(iv) Nationality;

(v) Signature of the salesman introducing the account and signature of the partner, officer or manager who accepts the account;

(vi) If the customer is a corporation, partnership or other legal entity, the names of any person authorized to transact business on behalf of the entity;

(vii) Specimen signature; and

(viii) Option whether confirmation of customer orders would be via courier or electronically.

(b) For each account other than an institutional account, the Trading Participant shall obtain, prior to the settlement of the initial transaction in the account, the following information to the extent it is applicable to the account:

(i) Customer's tax identification number;

(ii) Occupation of customer and name and address and telephone number of employer, and e-mail address, if employed;

(iii) Whether the customer is employed by or otherwise associated with another Trading Participant (e.g., officer, director, salesman, or shareholder);

(iv) Whether the customer is an officer or director of a company listed on an exchange;

(v) The customer's investment objective and other related information concerning the customer's financial situation and needs;

(vi) If duplicate confirmations are required to be sent to another person, the identity of that person and his relationship to the customer; and

(vii) Source of funds.

(c) For discretionary accounts, the Trading Participant shall also:

(i) Obtain the signature of each person authorized to exercise discretion in the account; and

(ii) Record the date such discretion is granted.

(d) For corporate or institutional accounts, the Trading Participant shall obtain, prior to the settlement of the initial transaction in the account, the following information to the extent it is applicable to the account:

(i) Articles of Incorporation/Partnership;

(ii) By-laws;

(iii) Official address or principal business address;

(iv) Secretary's certificate of board resolution authorizing the opening of the account with the Trading Participant;

(v) List of directors/partners;

(vi) List of stockholders owning at least two percent (2%) of the capital stock;

(vii) Contact numbers;

(viii) Beneficial owners, if any;

(ix) Verification of the authority and identification of the person purporting toact on behalf of the client;

(x) Financial Information;

(xi) Investment objective; and

(xii) All other information contained in the prescribed Customer Account

Information Form ("CAIF").

Description:

- Customer with incomplete data in CAIF

- CAIF is not sufficient to cover the requirements

Sanction: Major Violation (Article XII, Section 4(b))

(b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more than Php30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Classification of Violations:

Article XII, Section 3(b) (v)

(v) Making untrue statements or the omission of any material fact required or necessary to be stated in CAIF, reports, records, books and documents submitted to CMIC for such not to be misleading;"

Rule: Article VII, Section 1(n)

Section 1. Customer Account Information Rule. Every Trading Participant shall maintain customer accounts opened as follows:

(n) All existing CAIFs of active clients shall be updated or amended annually to comply with the new requirements within the period prescribed in the SRC Rules.

Description:

- Un-updated CAIF

- Updating is only done when the client goes to the office of the TPs.

Sanction: Major Violation (Article XII, Section 4(b))

(b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more than Php30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Classification of Violations:

Article XII, Section 3(b)( v)

(v) Making untrue statements or the omission of any material fact required or necessary to be stated in CAIF, reports, records, books and documents submitted to CMIC for such not to be misleading;"

Rule: Article VII, Section 1(o)

" (o) It is the Trading Participant's duty to know its clients well and, accordingly, it shall be primarily responsible in keeping current all material information contained in the CAIF. "

Description:

- Diligence to Know your Customer

Sanction: Major Violation (Article XII, Section 4(b))

(b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more than Php30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Classification of Violations:

Article XII, Section 3(b)( v)

"(v) Making untrue statements or the omission of any material fact required or necessary to be stated in CAIF, reports, records, books and documents submitted to CMIC for such not to be misleading;"

Rule: Article VII, Section 1(q)

"(q) Trading Participants should also comply with the provisions on Identification of Customers' Accounts and Orders through the Use of Code, Symbol or Account Number and Multiple Accounts contained in the Trading Rules of the Exchange."

Description:

- Improper tagging of client codes

Sanction: Major Violation (Article XII, Section 4(b))

(b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more than Php30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Classification of Violations:

Article XII, Section 3(b) (v)

"(v) Making untrue statements or the omission of any material fact required or necessary to be stated in CAIF, reports, records, books and documents submitted to CMIC for such not to be misleading;"

Rule: Article VII, Section 4(a)

"Order Ticket Rule (a) Every order received by a Trading Participant or any other Associated Person or salesman of a Trading Participant to buy or sell securities for customers shall be entered on an order form, which shall contain at the minimum, all the information required by this Rule. Each buying or selling order form shall be time stamped by the Trading Participant or any other associated person or salesman of a Trading Participant or any person acting on his behalf upon receipt of the customer's order and upon transmission to the trading floor, if necessary. Time recording of subsequent action on an order, whether for amendment, cancellation or actual matching thereof, shall be captured by the computerized trading system of the Exchange or by time stamping, for over-the-counter (OTC) transaction. Any such information captured by the computerized trading system of the Exchange shall be printed and made available for legal and/or audit purposes. "

Description:

- No time stamp in order ticket

- Late time stamping of orders

Sanction: Major Violation (Article XII, Section 4(b))

(b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more than Php30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Classification of Violations:

Article XII, Section 3(b)( v)

(v) Making untrue statements or the omission of any material fact required or necessary to be stated in CAIF, reports, records, books and documents submitted to CMIC for such not to be misleading;"

Rule: Article VII, Section 12(a)

"Customer Account Statement (a) A Trading Participant shall send a monthly statement of account to active clients containing a description of any securities positions, money balances, or account activity, to each customer whose account had a security position, money balance, or account activity during the period since the last such statement was sent to the customer. In exceptional cases and only upon written request made by the customer, the Trading Participant may issue quarterly statements in lieu of monthly statements. The written request by the customer shall be kept in the firm's files for the Commission's or CMIC's audit/investigation purposes."

Description:

Sanction: Major Violation (Article XII, Section 4(b))

(b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more than Php30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Classification of Violations:

Article XII, Section 3(b) (v)

(v) Making untrue statements or the omission of any material fact required or necessary to be stated in CAIF, reports, records, books and documents submitted to CMIC for such not to be misleading;"

Rule: Article VII, Section 19 par. 1

Special Reserve Bank Account for the Exclusive Benefit of Customers. Every Trading Participant shall maintain with a bank/s at all times when deposits are required or hereinafter specified a "Special Reserve Bank Account for the Exclusive Benefit of Customers" (hereinafter referred to as the "Reserve Bank Account"), and it shall be separate from any other bank account of the Trading Participant. A Trading Participant shall at all times maintain in the Reserve Bank Account, through deposits made therein, cash (by maintaining a separate bank deposit) and/or qualified securities (by opening a custody account) in amounts computed in accordance with the prescribed formula."

Description:

- No separate bank account for exclusive benefit of customers

Sanction: Major Violation (Article XII, Section 4(b))

(b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more than Php30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Classification of Violations:

Article XII Section 3(b) 1

"(i) Violation of capitalization requirements of a Trading Participant, subject to SEC Memorandum Circular No. 16 Series 2004 and the provision of Article VIII of this rules;"

Rule: Article VII, Section 19 par. 4

"Computations necessary to determine the amount required to be deposited shall be made weekly, as of the close of the last business day of the week and the deposit so computed shall be made no later than one (1) hour after the opening of banking business on the second following business day; Provided, however, a Trading Participant which has aggregate indebtedness not exceeding 800 percent of net capital as defined in SRC Rule 49.1 and which carries aggregate customer funds as computed at the last required computation pursuant to this rule, not exceeding Php25 million may, in the alternative, make the computation monthly, as of the close of the last business day of the month, and in such event, shall deposit not less than one hundred five percent (105%) of the amount so computed no later than one (1) hour after the opening of banking business on the second following business day."

Description:

- Late/non deposit of required amount for reserve.

Sanction: Major Violation (Article XII, Section 4(b))

(b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more than Php30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Classification of Violations:

Article XII, Section 3(b) (1)

"(i) Violation of capitalization requirements of a Trading Participant, subject to SEC Memorandum Circular No. 16 Series 2004 and the provision of Article VIII of this rules;"

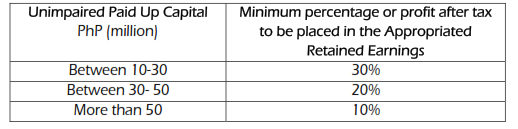

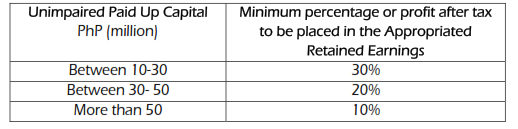

Rule: Article VIII-A, Section 2(2.1)(B)(1)

"Every Trading Participant shall annually appropriate a certain minimum percentage of its Audited profit after tax and transfer the same to the Appropriate Retained Earnings Account in accordance with the following schedule:

Description:

- Improper computation of the Reserve Fund

- Failure to appropriate Retained Earnings

Sanction: Major Violation (Article XII, Section 4(b))

(b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more thanPhp30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Article XII, Section 3(b)( i)

(i) Violation of capitalization requirements of a Trading Participant, subject to SEC Memorandum Circular No. 16 Series 2004 and the provision of Article VIII of this rules;

Rule: Article VIII-A, Section 2(2.2) 2nd paragraph

"With respect to compliance with the requirements on RBCA, every Trading Participant covered by the RBCA rules shall prepare its RBCA Report as of month end and file the same with the Commission and CMIC on or before the 15th of the following month."

Description:

- Delayed submission of Monthly RBCA

Sanction: Major Violation (Article XII, Section 4(b))

(b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more than Php30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Classification of Violations:

Article XII, Section 3(b) (i)

(i) Violation of capitalization requirements of a Trading Participant, subject to SEC Memorandum Circular No. 16 Series 2004 and the provision of Article VIII of this rules;

Rule: Article VIII-A, Section 2(2.6)(A)(A.2)(a.2)

"a.2. Notwithstanding the monthly reporting to be made to the Commission and CMIC on its RBCA as of month end, every Trading Participant shall compute its Net RBCA Margin and RBCA Ratio on a daily basis and these working papers will form part of the Books and Records of the firm. The Commission or CMIC, in the case of a member of an Exchange, may require Trading Participants from time to time to submit reports which reflect their RBCA Ratio and Margin. In such cases, the Trading Participant shall immediately submit said reports to the CMIC or the Commission."

Description:

- Non computation of RBCA on a daily basis

Sanction: Major Violation (Article XII, Section 4(b))

(b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more than Php30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Classification of Violations:

Article XII, Section 3(b) (i)

(i) Violation of capitalization requirements of a Trading Participant, subject to SEC Memorandum Circular No. 16 Series 2004 and the provision of Article VIII of this rules;

Rule: Article VIII-A, Section 2(2.6)(A)(A.4)(b.2)

"b.2. The 3-year average gross revenue value shall be calculated on the basis of the audited financial statements of the last three (3) years immediately preceding the date of reporting which have been filed and submitted with the Commission.

For this purpose, the term "Gross Revenue" shall refer to all sources of revenue of the Trading Participant, net of any relevant final tax, if any, which include among, others:

a. Commission Income

b. Interest Revenue

c. Net Recovery from (provision for) market decline of marketable securities owned

d. Rental Revenue

e. Dividend Revenue

f. Gain on sales of marketable securities and other assets

g. Other gains/revenues

For purposes of computing "Gross Revenue," losses are not netted against revenue accounts."

Description:

- Netting of Losses to Revenue

- Non usage of Annual Audited Financial Statement

- Not netted final tax

- Omission of certain items in the computation of ORR.

Sanction: Major Violation (Article XII, Section 4(b))

(b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more than Php30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Classification of Violations:

Article XII, Section 3(b)( i)

(i) Violation of capitalization requirements of a Trading Participant, subject to SEC Memorandum Circular No. 16 Series 2004 and the provision of Article VIII of this rules;

Rule: Article VIII-A, Section 2(2.6)A(A.5)(a.2)

"a.2. Equity securities shall be classified according to (1) Equities in PSEi; (2) Other Equities outside the PSEi; and (3) Equities not Listed in the Exchange but proven to be marketable, with separate position risk factors being applied to each category as provided in Schedule A of

SEC Memorandum Circular No. 16 series of 2004; "

Description:

- Erroneous classification of trading securities according to Equities within PSEi and Equities outside PSEi.

Sanction: Major Violation (Article XII, Section 4(b))

(b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more than Php30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Classification of Violations:

Article XII, Section 3(b)( i)

(i) Violation of capitalization requirements of a Trading Participant, subject to SEC Memorandum Circular No. 16 Series 2004 and the provision of Article VIII of this rules;

Rule: Article VIII-A, Section 2(2.6)(A)(A.6)(a.2)(i)

"i. Counterparty Risk Requirement (CRR) shall be computed only for negative exposures to a counterparty and not for positive exposures. "

Description:

- Error in computing CRR due to inclusion of positive exposures

Sanction: Major Violation (Article XII, Section 4(b))

(b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more than Php30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Classification of Violations:

Article XII, Section 3(b) (i)

(i) Violation of capitalization requirements of a Trading Participant, subject to SEC Memorandum Circular No. 16 Series 2004 and the provision of Article VIII of this rules;

Rule: Article IX, Section 1(b)

"(b) General Ledger - A Trading Participant shall have a General Ledger reflecting all its assets and liabilities, and its income and expense and capital accounts, and from which a trial balance can be abstracted in order to prepare financial statements showing the Trading Participant's financial condition."

Description:

- Trial balance per system does not tally with the trial balance in the RBCA

Sanction: Major Violation (Article XII, Section 4(b))

(b) Major Violations

(i) First violation - Fine of at least Php10,000.00 but not more than Php30,000.00;

(ii) Second violation - Fine of at least Php30,000.00 but not more than Php50,000.00;

(iii) Third violation - Fine of at least Php50,000.00 but not more than Php75,000.00;

(iv) Fourth and subsequent violations - Fine of at least Php75,000.00.

Classification of Violations:

Article XII, Section 3(b)(v)

"(v) Making untrue statements or the omission of any material fact required or necessary to be stated in CAIF, reports, records, books and documents submitted to CMIC for such not to be misleading;"

Rule: Article XI-B, Section 2

"Obligation to Report Known or Suspected Violations. Should a Trading Participant know or suspect a customer's transaction to constitute Unusual Trading Activities, Trading-related Irregularities or any other violation of the Securities Laws, the Trading Participant shall report in writing to CMIC such knowledge or suspicion within twenty-four (24) hours from receipt of the customer's order for the transaction. A Trading Participant shall be disputably presumed engaged in Unusual Trading Activities, Trading related Irregularities or other violation of the Securities Laws if the Trading Participant fails to make said report to CMIC within the given period."

Description:

- Failed to inform CMIC in writing its knowledge or suspicion of a client's transactions which possibly constitute unusual trading activities, trading related irregularities or other violations of Securities Laws.

Sanction: Grave Violation (Article XII, Section 4(a))

"(a) Grave Violations

(i) First violation - Written reprimand and fine in the amount of at least Php25,000.00 but not exceeding Php200,000.00;

(ii) Second violation - Denial of (1) the exercise of the Trading Right and (2) access to the facilities and systems of the Exchange;

(iii) Third and subsequent violations - Bar the erring Trading Participant from entry to or employment in or any kind of commercial association with the Exchange or other Trading Participant."

Classification of Violations:

Article XII, Section 3(a)(iii)

"(iii) Trading-related Irregularities;"

Rule: Article XI-B, Section 9

"Manipulative Schemes. Set forth below are non-exclusive examples of types of prohibited conduct:

(a) Engaging in a series of transactions in securities that are reported publicly to give the impression of activity or price movement in a security (e.g. painting the tape);

(b) Posting actual or fictitious bid or offer at or near the close of the market, whether matched/executed or not, in an effort to alter or is likely to have the effect of altering the closing price of the security (marking the close);

(c) Engaging in transactions where both the buy and sell orders are entered at substantially the same time with the same price and quantity by different but colluding parties (improper matched orders);

(d) Engaging in buying activity at increasingly higher prices and then selling securities in the market at the higher prices (hype and dump);

(e) Engaging in transactions in which there is no genuine change in actual ownership of a security (wash sales);

(f) Taking advantage of a shortage of securities in the market by controlling the demand side and exploiting market congestion during such shortages in away as to create artificial prices (squeezing the float);

(g) Disseminating false or misleading market information through media, including the internet, or any other means to move the price of a security ina direction that is favorable to a position held or a transaction."

Description:

- Painting the tape

- Wash sale

- Hype and dump

Sanction: Grave Violation (Article XII, Section 4(a))

"(a) Grave Violations

(i) First violation - Written reprimand and fine in the amount of at least Php25,000.00 but not exceeding Php200,000.00;

(ii) Second violation - Denial of (1) the exercise of the Trading Right and (2) access to the facilities and systems of the Exchange;

(iii) Third and subsequent violations - Bar the erring Trading Participant from entry to or employment in or any kind of commercial association with the Exchange or other Trading Participant."

Classification of Violations:

Article XII, Section 3(a)( iii)

"(iii) Trading-related Irregularities;"

|